Your Guide to Billing and Revenue Codes as an Addiction Treatment Center

Running a detox or inpatient facility that provides therapeutic services means walking a thin line between rehabilitation and diagnostic services. Staying in business means adhering to operational sustainability while simultaneously taking care of your substance abuse or psychiatric clinic.

Understanding your facility’s financial infrastructure, including medical billing, can be as important as understanding the healthcare setting clients experience during clinic visits. Billing and revenue codes are your organization’s go-to system for accurately reimbursing insurance agents for the services they provide.

Using different codes isn’t just about paying for services provided; it also involves maintaining compliance, general classification, and ensuring your facility remains profitable.

In this guide, Ads Up Marketing breaks down the most relevant detox and inpatient rehab revenue codes, how to use them correctly, and how to avoid common billing issues.

What Are Revenue Codes?

Revenue codes are 4-digit numerical codes used in hospitals and other treatment centers to indicate the type of services provided. They are required on UB-04 claim forms and submitted to the insurance company for processing. Insurance companies, including Medicare, Medicaid, and private payers, utilize these codes for reimbursement purposes.

Unlike CPT (Current Procedural Terminology) or HCPCS (Healthcare Common Procedure Coding System) codes, which specify what procedure or service was performed, revenue codes clarify where and how the therapeutic services were delivered.

Consider revenue codes as the umbrella category that classifies the cost center for the following services:

- Specific services during inpatient treatment

- Outpatient services

- Room and board costs that are separate from the services provided

- Therapy services within those settings

Using the incorrect revenue code can result in denied claims, underpayment, or compliance risks during audits.

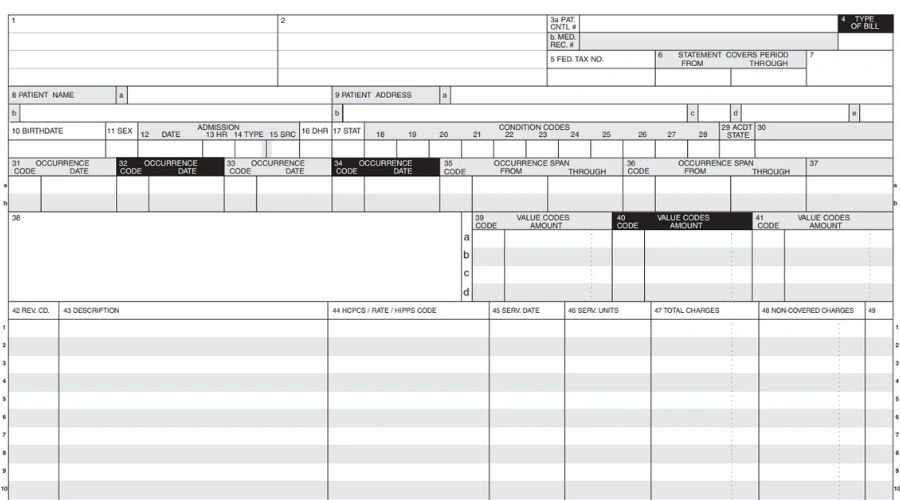

The UB-04 Form and Revenue Code Fields

All facility-based addiction treatment billing relies on the UB-04 form, also known as the CMS-1450. This form includes designated fields where revenue codes are entered, particularly:

- Form Locator 42 – Cost per unit of service

- Form Locator 44 – CPT/HCPCS code (if applicable)

- Form Locator 46 – Units, or hours of service during each therapy session

- Form Locator 47 – Total charges for the service

Each revenue code is paired with charges and may be associated with a CPT or HCPCS code for more precise billing purposes.

Common Revenue Codes for Detox Services

Detoxification services are typically medically monitored, making them a distinct cost center that must be coded correctly for reimbursement.

Key detox-related revenue codes include:

- 0114 – Room and board, private room (detox services)

- 0124 – Room and board, semi-private room (detox services)

- 0901 – Alcohol and drug treatment facility (general services)

- 0944 – Detoxification (chemical dependency)

- 0912 – Individual therapy during the detox phase

Some payers request modifiers or require CPT codes (H0009 for alcohol/drug assessment) to combine with diagnostic codes for detox services. Be sure to verify with different insurance providers.

Proper documentation is essential to justify medical necessity, especially if billing higher-level detox services requiring 24/7 nursing or a psychiatric evaluation.

Common Revenue Codes for Inpatient Rehab Services

After a client finishes detox, many transition into inpatient or other therapeutic services like partial hospitalization. These care levels include structured programming, therapy, and 24-hour support (in the case of inpatient treatment), but are not medically monitored the same way as detox.

Inpatient revenue codes for inpatient medical billing include:

- 0110–0119 – Room and board, general classification (emergency room visits, wards, and suites)

- 0901 – Alcohol and drug abuse treatment services

- 0913 – Group therapy (part of services provided during inpatient, depending on patient’s diagnosis)

- 0917 – Behavioral health rehabilitation services

- 0942 – Education and training (relapse prevention, life training, and other aftercare programs)

Rehab facilities should bundle services together as needed. This reflects the length of stay, type of room, and daily treatment and evaluation hours.

For example, a 30-day inpatient rehab stay with daily group sessions might include:

- 30 units of 0913 (group therapy)

- 30 units of 0110 (room and board)

- Weekly entries of 0912 for individual therapy

Detox vs. Inpatient: Revenue Code Scenarios

Let’s unpack how billing would differ in two standard services:

Scenario 1: Medical Detox Followed by Inpatient Rehab

A client is admitted for 5 days of detox, then transitions to a 25-day inpatient rehab stay with other therapeutic services:

- Days 1–5 (Urgent Care Clinic or Emergency Room to Detox):

- 0944 – Revenue codes for Detox services or procedures for the patient. This can include diagnostic services.

- 0114 – Private room revenue codes

- 0912 – Daily individual therapy revenue codes

● Days 6–30 (Inpatient):

- 0110 – General room and board revenue codes

- 0913 – Group therapy or family practice clinic if group therapy involves husbands, wives, children, etc.

- 0917 – Revenue codes for behavioral health services

- 0942 – Revenue codes for education sessions

Proper coding maintains full reimbursement, especially if the necessity of the detox is documented and preauthorized.

Scenario 2: Dual Diagnosis Inpatient Program

During dual diagnosis diagnostic services, a client is treated for both addiction and a co-occurring mental health disorder. This typically occurs during a 28 or 30 day residential program.

● Medical Billing Revenue Codes:

- 0913 – Group therapy for substance use

- 0912 – Individual psychotherapy procedures

- 0917 – Behavioral health rehab (mental health-specific)

- 0110 – Room and board revenue codes

- 0942 – Revenue codes for educational programming

Each day, documentation should accurately match the services rendered (including imaging services and other diagnostic services) so that the insurance company can identify them.

Tips for Accurate Billing and Compliance

Efficient and correct coding, whether CPT coding or otherwise, is only a single portion of the procedures and codes process. Ensuring you maintain clean documentation and understanding payer requirements is equally important.

This is where many facilities become confused when it comes to billing codes for procedures and services rendered.

The following tips will help ensure that you remain compliant when billing for creating treatment plans and other diagnostic services:

- Align all of your documentation and billing. Therapy session notes must match the revenue codes billed, especially for services such as individual counseling or education.

- Always remember to verify payer rules. Some insurers require prior authorization or limit the number of units per week. Sometimes, it’s possible to circumvent these limits with a fax or letter explaining the services to the insurance company, but not in every case. Ensure this is possible before moving forward with specific treatment procedures.

- Train your team correctly. Your staff should understand how notes can impact the billing process. Teach them how to use regular audits and chart reviews to ensure that all services are appropriately documented.

- Keep your policies updated. Also, ensure your billing procedures are up to date with CMS and other insurance carrier changes.

Even the most minor errors, such as using 0913 without a corresponding therapy note, can result in a denied claim.

The Role of Medical Necessity in Detox and Inpatient Reimbursement

Each payer, especially Medicaid and Medicare, requires proof that treatment was medically necessary and beneficial to the client. This is especially important during the detox phase of rehab.

To document medical necessity, give the proper attention to the following:

- Include vitals, labs, or psychiatric evaluations in the records you maintain.

- Document any symptoms of withdrawal, risk of seizures, or co-occurring mental health issues. You should also note if there are any other emergency room visits, if the situation becomes more challenging.

- Use evidence-based criteria (ASAM levels of care) to explain and justify the placement of clients.

Missing important documentation is one of the primary reasons for claims denial. This is especially true in the case of higher-cost detox codes.

When to Use a Billing Partner

Running an addiction treatment center presents numerous challenges. Outsourcing your billing to a third-party medical billing organization can help reduce stress and increase revenue collection.

There are several primary benefits to using a professional billing partner for identifying treatment and other diagnostic services, including:

- Higher acceptance rates during the first pass to the insurance company.

- Knowledge of payer rules and critical industry changes.

- A dedicated team to track denials and appeals, and other pertinent events regarding the billing process.

- Expertise in UB-04 forms, modifiers, and revenue code combinations.

Look for a billing partner with experience in behavioral health and substance use disorder services. If possible, avoid companies that specialize in general healthcare. You’re likely to have a more professional and efficient experience by using a company that specializes in the rehabilitation niche alone.

Ads Up Marketing Offers Resources and Support for Owners

Ensuring accuracy in the complex area of detox and inpatient rehab revenue codes can be extremely overwhelming, especially without an experienced staff. However, it’s critical for the success and longevity of your substance abuse treatment center.

Efficient coding, strong documentation, and knowledge of payer rules are essential cornerstones of a healthy revenue cycle for any rehabilitation facility.

By understanding and correctly using pivotal revenue codes, such as 0944 for detoxification to 0913 for group therapy, you can ensure that your services are reimbursed fairly and promptly.

At Ads Up Marketing, we are digital marketers for the addiction treatment space, though we can assist with some of the intricacies of the billing process and provide you with resources and industry partners who specialize in compliance and billing elements.

This way, you can focus on what matters most: delivering compassionate, evidence-based care to those in recovery, while maintaining financial viability in the long run.

Schedule your confidential consultation and help your facilities drive revenues and lower your CPAs, get started today!

Free Digital Marketing Analysis